2024-08 Signs of Recovery in the Semiconductor Industry Are Becoming More Obvious

SIA President and CEO John Neuffer stated: "The global semiconductor market remained strong in the second quarter of 2024, with quarterly sales showing growth for the first time since the fourth quarter of 2023. Sales in June increased both month-on-month and year-on-year, with the Americas leading the way with a 42.8% increase compared to June 2023.

Regionally, in addition to the year-on-year growth in the Americas, sales in mainland China (21.6%) and the Asia-Pacific/All Others (12.7%) also saw increases, while sales in Japan (-5.0%) and Europe (-11.2%) experienced declines. Monthly sales in June increased in the Americas (6.3%), Japan (1.8%), and mainland China (0.8%), but decreased in Europe (-1.0%) and the Asia-Pacific/All Others market (-1.4%).

A Slow Start to 2024, but Prepared for Growth

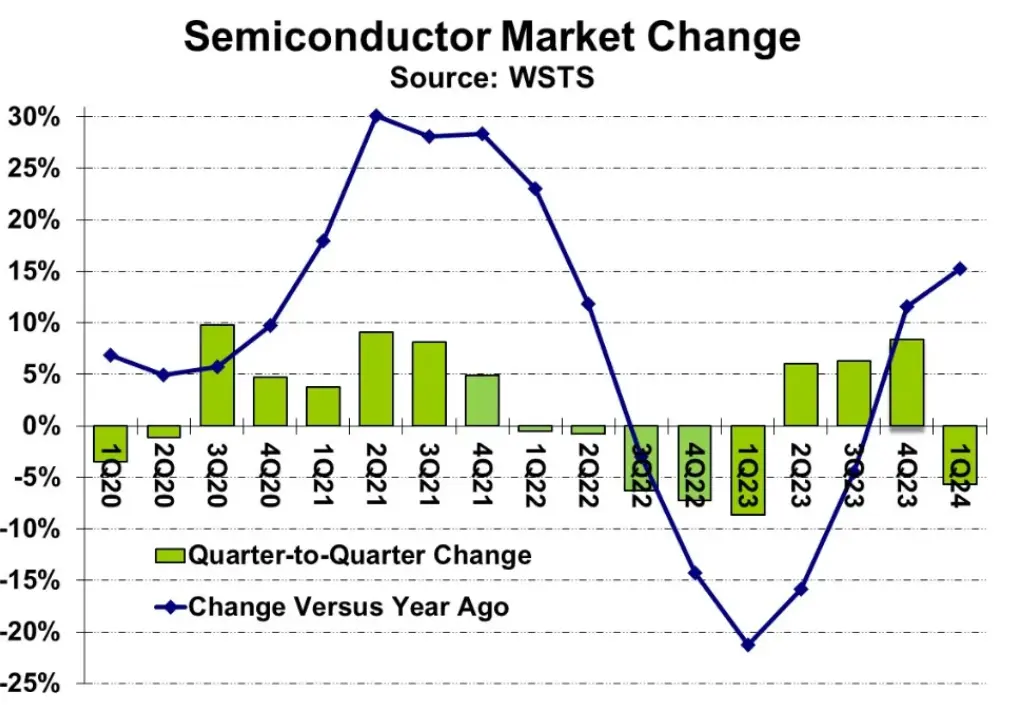

According to WSTS data, the global semiconductor market size in the first quarter of 2024 was $137.7 billion. The first quarter of 2024 saw a 5.7% decline compared to the fourth quarter of 2023, but a 15.2% increase compared to the same period last year. The first quarter of this year typically experiences a seasonal decline compared to the previous year’s fourth quarter. However, the 5.7% decline in the first quarter of 2024 was more than expected."

As an advanced chip bonding technology, Hybrid Bonding will play a key role in the future development of the semiconductor industry. With the rapid advancement of fields such as AI and high-performance computing, the demands for chip performance and power consumption are continuously increasing. Hybrid Bonding technology will provide strong support to meet these needs. We look forward to seeing the application of Hybrid Bonding technology in more areas, bringing further innovation and breakthroughs to the semiconductor industry.

Signs of Recovery in the Semiconductor Industry Are Becoming More Obvious

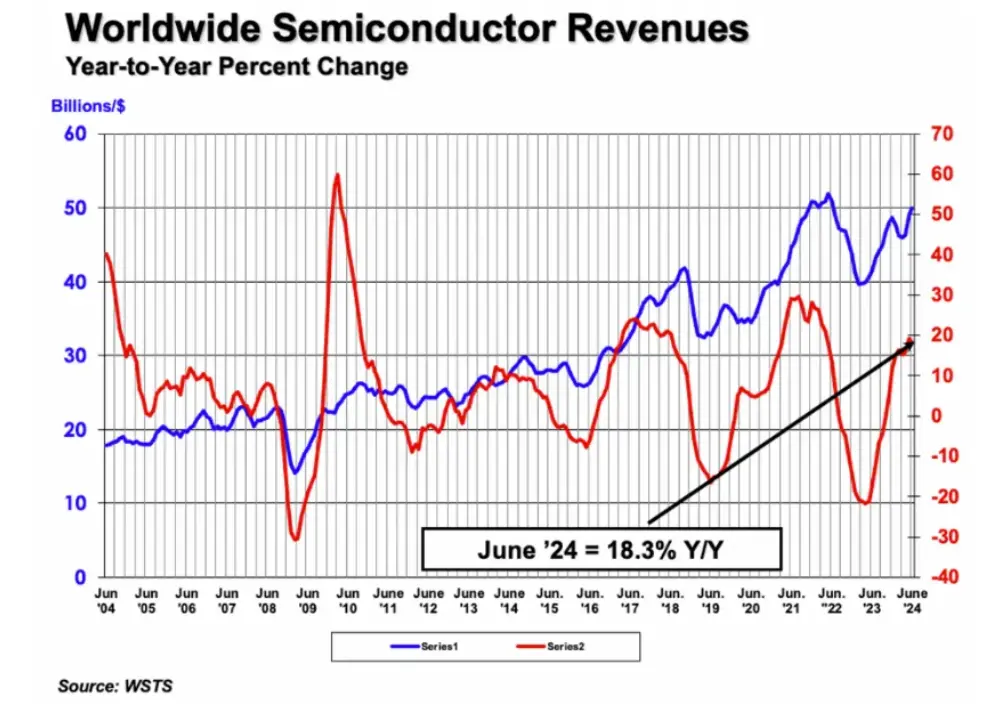

In the second quarter of 2024, global semiconductor sales increased by 18.3% year-on-year and 6.5% quarter-on-quarter.

The Semiconductor Industry Association (SIA) announced that global semiconductor industry sales totaled $149.9 billion in the second quarter of 2024, representing an 18.3% increase compared to the second quarter of 2023 and a 6.5% increase from the first quarter of 2024. Sales in June 2024 reached $50 billion, up 1.7% from $49.1 billion in May 2024. Monthly sales figures are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. In terms of revenue, the chip companies accounted for 99% of the U.S. semiconductor industry and nearly two-thirds of the non-U.S. semiconductor industry, according to SIA statistics.

SIA President and CEO John Neuffer stated: "The global semiconductor market remained strong in the second quarter of 2024, with quarterly sales showing growth for the first time since the fourth quarter of 2023. Sales in June increased both month-on-month and year-on-year, with the Americas leading the way with a 42.8% increase compared to June 2023.

Regionally, in addition to the year-on-year growth in the Americas, sales in mainland China (21.6%) and the Asia-Pacific/All Others (12.7%) also saw increases, while sales in Japan (-5.0%) and Europe (-11.2%) experienced declines. Monthly sales in June increased in the Americas (6.3%), Japan (1.8%), and mainland China (0.8%), but decreased in Europe (-1.0%) and the Asia-Pacific/All Others market (-1.4%).

A Slow Start to 2024, but Prepared for Growth

According to WSTS data, the global semiconductor market size in the first quarter of 2024 was $137.7 billion. The first quarter of 2024 saw a 5.7% decline compared to the fourth quarter of 2023, but a 15.2% increase compared to the same period last year. The first quarter of this year typically experiences a seasonal decline compared to the previous year’s fourth quarter. However, the 5.7% decline in the first quarter of 2024 was more than expected."

The Performance of Major Semiconductor Companies in the First Quarter of 2024 is Mixed

The revenue changes from the fourth quarter of 2023 to the first quarter of 2024 varied from a 23% increase reported by Micron Technology to a 19% decrease reported by STMicroelectronics. Five companies reported quarter-on-quarter revenue growth, while nine companies saw declines. NVIDIA continued to be the largest semiconductor company, with revenue of $26 billion. The total revenue of leading companies grew by 2%, with memory chip manufacturers increasing by 12% and non-memory manufacturers declining by 2%.

Companies provided different revenue guidance for the second quarter of 2024. Micron expects strong demand for memory chips to continue, projecting a 13% increase in revenue for the second quarter of 2024 compared to the first quarter. Seven other companies anticipate revenue growth in the second quarter of 2024. Artificial intelligence (AI) is identified as a major growth driver by NVIDIA, Samsung, and SK Hynix. NXP Semiconductors expects its revenue in the second quarter of 2024 to remain flat compared to the first quarter. Three companies expect a decline. Qualcomm and MediaTek are seeing seasonal declines in the smartphone market. STMicroelectronics provided the lowest revenue guidance, projecting a 7.6% decline due to excess inventory in the industrial sector. The twelve companies providing guidance have a combined outlook for a 3% growth in the second quarter of 2024.

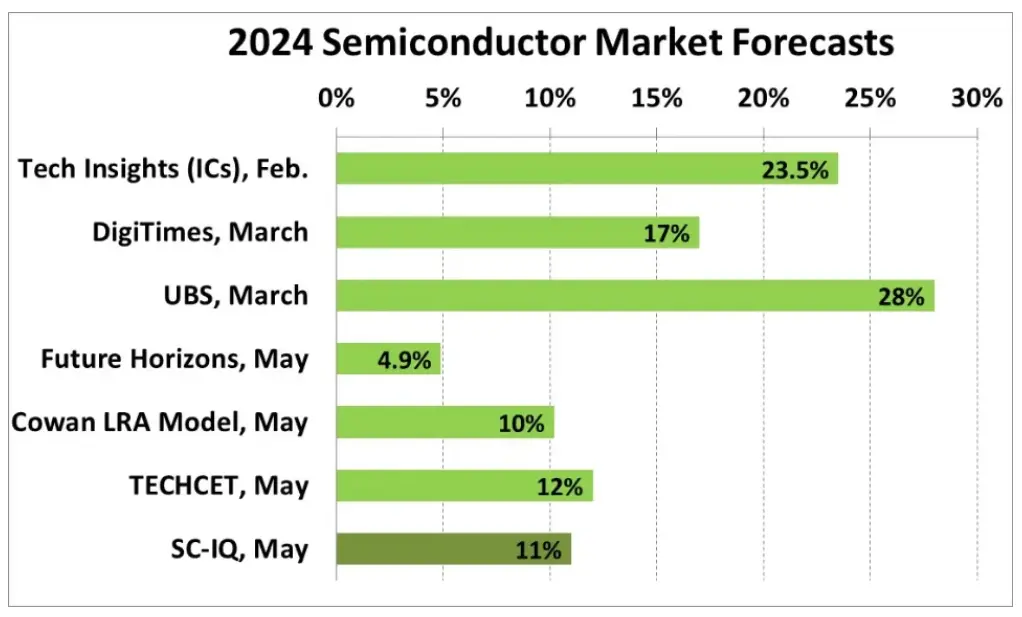

Recent estimates for the growth rate of the semiconductor market in 2024 range from 4.9% to 28%. However, the forecasts since the release of WSTS first-quarter data in early May have differed significantly from previous predictions. The forecasts released in February and March ranged from 17% by DigiTimes to 28% by UBS. Based on the WSTS data for the first quarter of 2024, Future Horizons revised its 2024 forecast down from 16% in January to 4.9% in May. Other May forecasts include 10% from the Cowan LRA model and 12% from TECHCET. Semiconductor Intelligence (SC-IQ) has lowered its expected growth rate for 2024 from 18% in February to 11% in May.

Signs of Recovery in the Semiconductor Industry Are Becoming More Obvious

In the second quarter of 2024, global semiconductor sales increased by 18.3% year-on-year and 6.5% quarter-on-quarter.

The Semiconductor Industry Association (SIA) announced that global semiconductor industry sales totaled $149.9 billion in the second quarter of 2024, representing an 18.3% increase compared to the second quarter of 2023 and a 6.5% increase from the first quarter of 2024. Sales in June 2024 reached $50 billion, up 1.7% from $49.1 billion in May 2024. Monthly sales figures are compiled by the World Semiconductor Trade Statistics (WSTS) organization and represent a three-month moving average. In terms of revenue, the chip companies accounted for 99% of the U.S. semiconductor industry and nearly two-thirds of the non-U.S. semiconductor industry, according to SIA statistics.

SIA President and CEO John Neuffer stated: "The global semiconductor market remained strong in the second quarter of 2024, with quarterly sales showing growth for the first time since the fourth quarter of 2023. Sales in June increased both month-on-month and year-on-year, with the Americas leading the way with a 42.8% increase compared to June 2023.

Regionally, in addition to the year-on-year growth in the Americas, sales in mainland China (21.6%) and the Asia-Pacific/All Others (12.7%) also saw increases, while sales in Japan (-5.0%) and Europe (-11.2%) experienced declines. Monthly sales in June increased in the Americas (6.3%), Japan (1.8%), and mainland China (0.8%), but decreased in Europe (-1.0%) and the Asia-Pacific/All Others market (-1.4%).

A Slow Start to 2024, but Prepared for Growth

According to WSTS data, the global semiconductor market size in the first quarter of 2024 was $137.7 billion. The first quarter of 2024 saw a 5.7% decline compared to the fourth quarter of 2023, but a 15.2% increase compared to the same period last year. The first quarter of this year typically experiences a seasonal decline compared to the previous year’s fourth quarter. However, the 5.7% decline in the first quarter of 2024 was more than expected."

The Performance of Major Semiconductor Companies in the First Quarter of 2024 is Mixed

The revenue changes from the fourth quarter of 2023 to the first quarter of 2024 varied from a 23% increase reported by Micron Technology to a 19% decrease reported by STMicroelectronics. Five companies reported quarter-on-quarter revenue growth, while nine companies saw declines. NVIDIA continued to be the largest semiconductor company, with revenue of $26 billion. The total revenue of leading companies grew by 2%, with memory chip manufacturers increasing by 12% and non-memory manufacturers declining by 2%.

Companies provided different revenue guidance for the second quarter of 2024. Micron expects strong demand for memory chips to continue, projecting a 13% increase in revenue for the second quarter of 2024 compared to the first quarter. Seven other companies anticipate revenue growth in the second quarter of 2024. Artificial intelligence (AI) is identified as a major growth driver by NVIDIA, Samsung, and SK Hynix. NXP Semiconductors expects its revenue in the second quarter of 2024 to remain flat compared to the first quarter. Three companies expect a decline. Qualcomm and MediaTek are seeing seasonal declines in the smartphone market. STMicroelectronics provided the lowest revenue guidance, projecting a 7.6% decline due to excess inventory in the industrial sector. The twelve companies providing guidance have a combined outlook for a 3% growth in the second quarter of 2024.

Recent estimates for the growth rate of the semiconductor market in 2024 range from 4.9% to 28%. However, the forecasts since the release of WSTS first-quarter data in early May have differed significantly from previous predictions. The forecasts released in February and March ranged from 17% by DigiTimes to 28% by UBS. Based on the WSTS data for the first quarter of 2024, Future Horizons revised its 2024 forecast down from 16% in January to 4.9% in May. Other May forecasts include 10% from the Cowan LRA model and 12% from TECHCET. Semiconductor Intelligence (SC-IQ) has lowered its expected growth rate for 2024 from 18% in February to 11% in May.

Current Issues:

In our April 2024 newsletter, we noted that robust growth should be seen in key end markets such as PCs and smartphones. Some markets that have seen growth in recent years, such as automotive and industrial, appear to be weakening. Artificial intelligence is an emerging growth driver. According to the International Monetary Fund, global economic growth is expected to stabilize at 3.2% over the next two years. These factors should support healthy growth in the semiconductor market in 2024 and 2025. However, earlier predictions of 20% or higher growth for 2024 are unlikely to prove accurate.

Wafer Foundry Industry Recovery

With increased electronics sales, stable inventory, and increased wafer fab capacity, the global semiconductor manufacturing industry showed signs of improvement in the first quarter of 2024. Stronger growth is expected in the second half of the year.

J.P. Morgan Securities noted in its latest report on the “Wafer Foundry Industry” that inventory destocking in the foundry sector will come to an end, and industry conditions are expected to broadly recover in the second half of 2024, with further enhancement in 2025.

Gokul Hariharan, head of J.P. Morgan’s Taiwan research department, analyzed that the industry hit bottom in the first quarter, coupled with rising AI demand and a gradual recovery in non-AI demand. More importantly, urgent orders have begun to appear, including large-size panel driver ICs (LDDIC), power management ICs (PMIC), and WiFi 5 and WiFi 6 chips, all clearly indicating that the wafer foundry industry is moving out of the trough and into recovery.

Notably, the capacity utilization rate of mainland China’s wafer foundries is recovering rapidly, primarily because semiconductor companies without fabs began adjusting their inventories earlier. After six consecutive quarters of active destocking, inventories are gradually normalizing.

In terms of non-AI demand, the 3C sectors, including consumer electronics, communications, and computing, also hit bottom in the first quarter of this year. However, automotive and industrial demand may recover by the end of 2024 or early 2025, mainly due to the overall inventory adjustment being delayed.

SEMI pointed out that sales of electronic terminal products increased by 1% year-on-year in the first quarter, while IC sales saw a strong year-on-year growth of 22%. It is expected that sales of electronic terminal products will increase by 5% year-on-year in the second quarter, along with increased shipments of high-performance computing (HPC) chips and continued improvement in memory prices, which will also drive IC sales to maintain strong growth, with a year-on-year increase of 21%. IC inventory levels have stabilized in the first quarter and are expected to improve further this quarter.

However, SEMI admitted that wafer fab capacity utilization rates remain low, especially in the mature process sector, which is still a concerning issue. It is expected that there will be no signs of recovery in the first half of this year, with memory utilization rates in the first quarter falling below expectations, primarily due to strict supply controls.

Wafer fab capital expenditures are consistent with capacity utilization trends, remaining conservative. Expenditures in the fourth quarter of last year decreased by 17% year-on-year, and the first quarter continued to decline by 11%. It is expected that expenditures will return to growth in the second quarter, with a slight increase of 0.7%, and capital expenditures related to memory are expected to grow by 8%, which is higher than in the non-memory sector.

SEMI’s global senior director, Zeng Ruiyu, stated that some semiconductor demand is recovering, but the pace of recovery is not uniform. Demand mainly comes from AI chips and high-bandwidth memory (HBM), driving investments and capacity expansion in related fields. However, due to the reliance of AI chips on a few key suppliers, the contribution to IC shipment growth is limited.

Boris Metodiev, director of market analysis at TechInsights, stated that semiconductor demand in the first half of this year is mixed. Due to the surge in demand for generative AI, there has been a rebound in memory and logic, but the slow recovery of the consumer market, along with inventory adjustments in the automotive and industrial markets, has disrupted the analog IC and discrete component markets.

Metodiev expects that as AI gradually spreads to edge devices, it is likely to drive consumer demand, and the semiconductor market is expected to fully recover in the second half of this year. Additionally, as the Federal Reserve lowers interest rates, consumer purchasing power will increase, leading to a decrease in inventory levels, while the automotive and industrial control markets are expected to return to growth in the second half of this year.

Contact Us

For any questions regarding our products or solutions, kindly entrust them to us and we will respond within 24 hours.

KeyWords

Wedge Bonding ToolWedge Tool

Bonding Wedge

Au Wire Bonding

Concave wedge Tool

Wedge Bonding Machines

Wire Bonding ToolsBonding Equipment SuppliersFine Pitch Bonding ToolsWedge BonderWire bonding equipmentSemiconductor bonding toolsPrecision bonding toolsHigh-performance wire bonding toolsSemiconductor industry toolsBonding tool manufacturerCustomizable wire bonding solutionsQuality wedge bonding equipment